rhode island property tax rates 2020

The countys average effective property tax rate is. 2020 Rhode Island Property Tax Rates Hover or touch the map below for more tax rate.

Property Tax Calculator Smartasset

FY 2019 Property Tax Cap.

. The municipality of Burrillville also saw a notable rise in. West Greenwich has a property tax rate of 2403. Tax amount varies by county.

Initial Application for Senior or Disabled Tax Credit. Property Tax Cap. Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state.

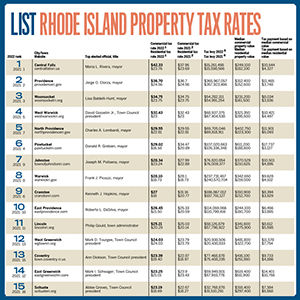

Providence has a property tax rate of 2456. 1463 for Real Estate and Tangible Property. 2022 Tax Rates Per thousand dollars of assessed value based on 100 valuation.

DO NOT use to figure your Rhode Island tax. Rhode Island Towns with the Highest Property Tax Rates. Recent Tax Rate History - Tax Rates from 1893 - 1996.

It kicks in for estates worth more than 1648611. For tax roll year 2020 the property tax rate for Cumberland was 1432. Online Property Tax Database.

If you live in Rhode Island and are thinking about estate planning this. FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial. Online Tax Bill Payment.

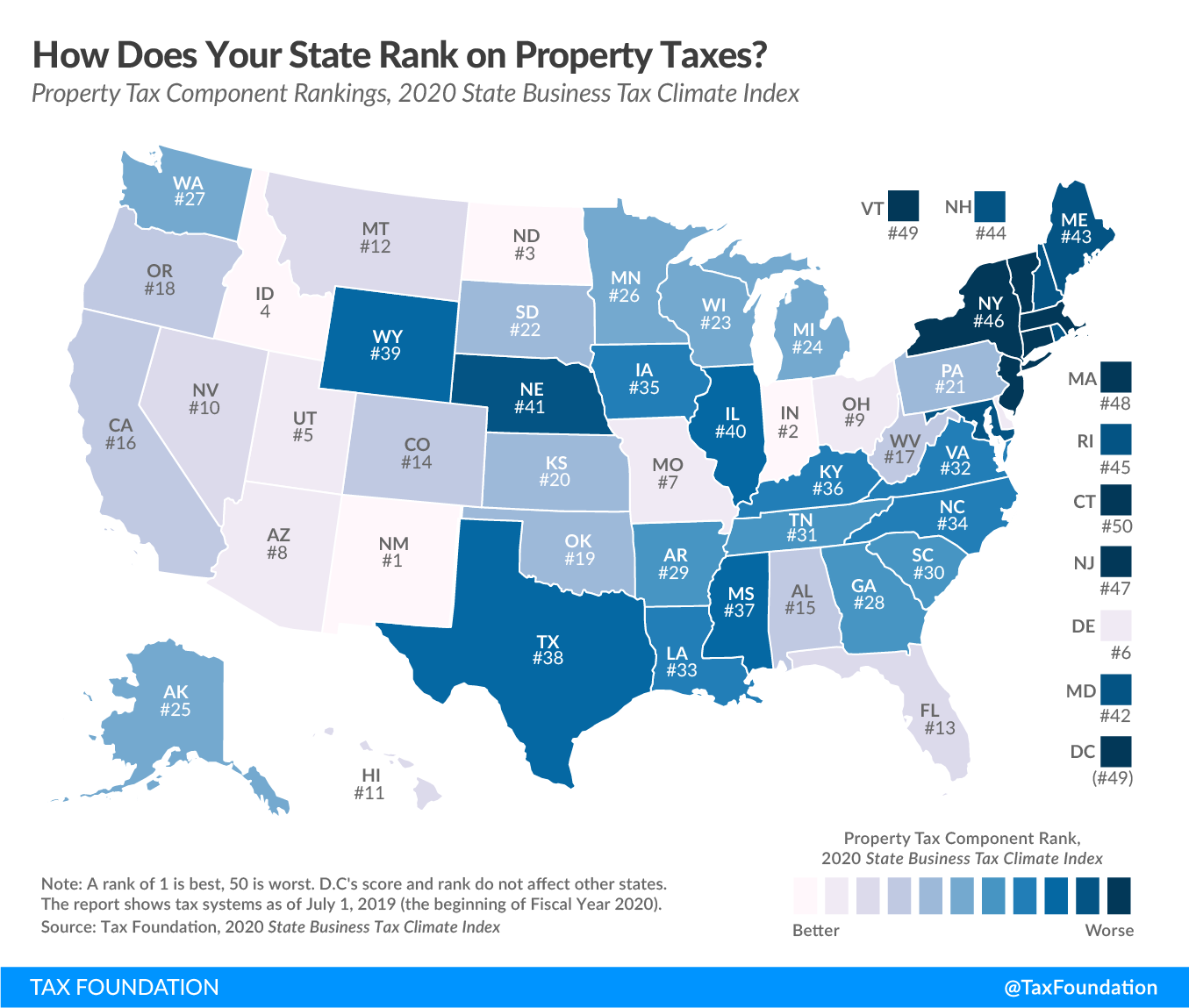

The current tax rates and exemptions for real estate motor vehicle and tangible property. Central Falls has a property tax rate of. 2020 Rhode Island Property Tax Rates on a Map - Compare Best and Worst RI Property Taxes Easily.

2989 - two to. Monday - Thursday 830 am - 530 pm. Instead if your taxable income.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. FY 2020 Property Tax Cap. FY 2021 Property Tax Cap.

Pensions Benefits Toggle child menu. That number recently ticked up to 1474. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

41 rows West Warwick taxes real property at four distinct rates. The top rate for the Rhode Island estate tax is 16. Property Tax Cap.

Pensions Benefits Toggle child menu. 135 of home value.

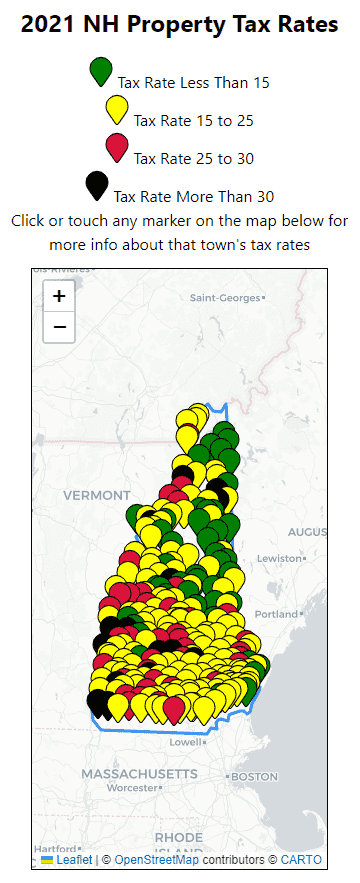

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Property Taxes By State Quicken Loans

City Proposes Lower Property Tax Rate But Homeowners May Still Pay More Denton Dentonrc Com

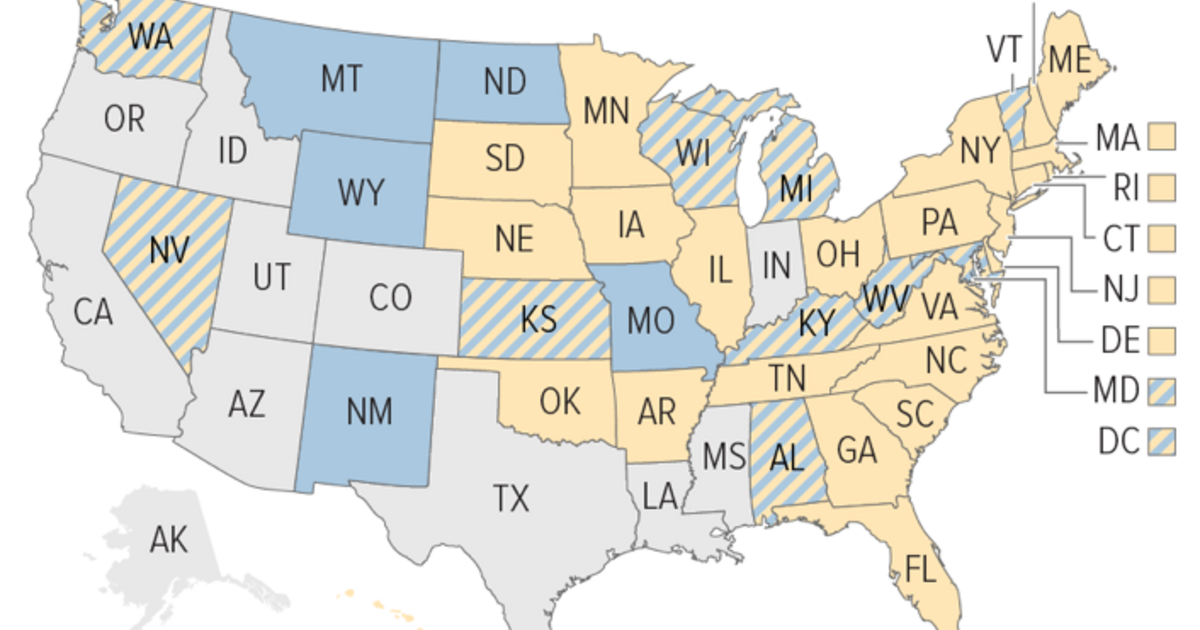

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

17 States With Estate Taxes Or Inheritance Taxes

Minnesota Results For The 50 State Property Tax Comparison Study For Taxes Payable In 2019

Map Of Rhode Island Property Tax Rates For All Towns

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

List Rhode Island Property Tax Rates

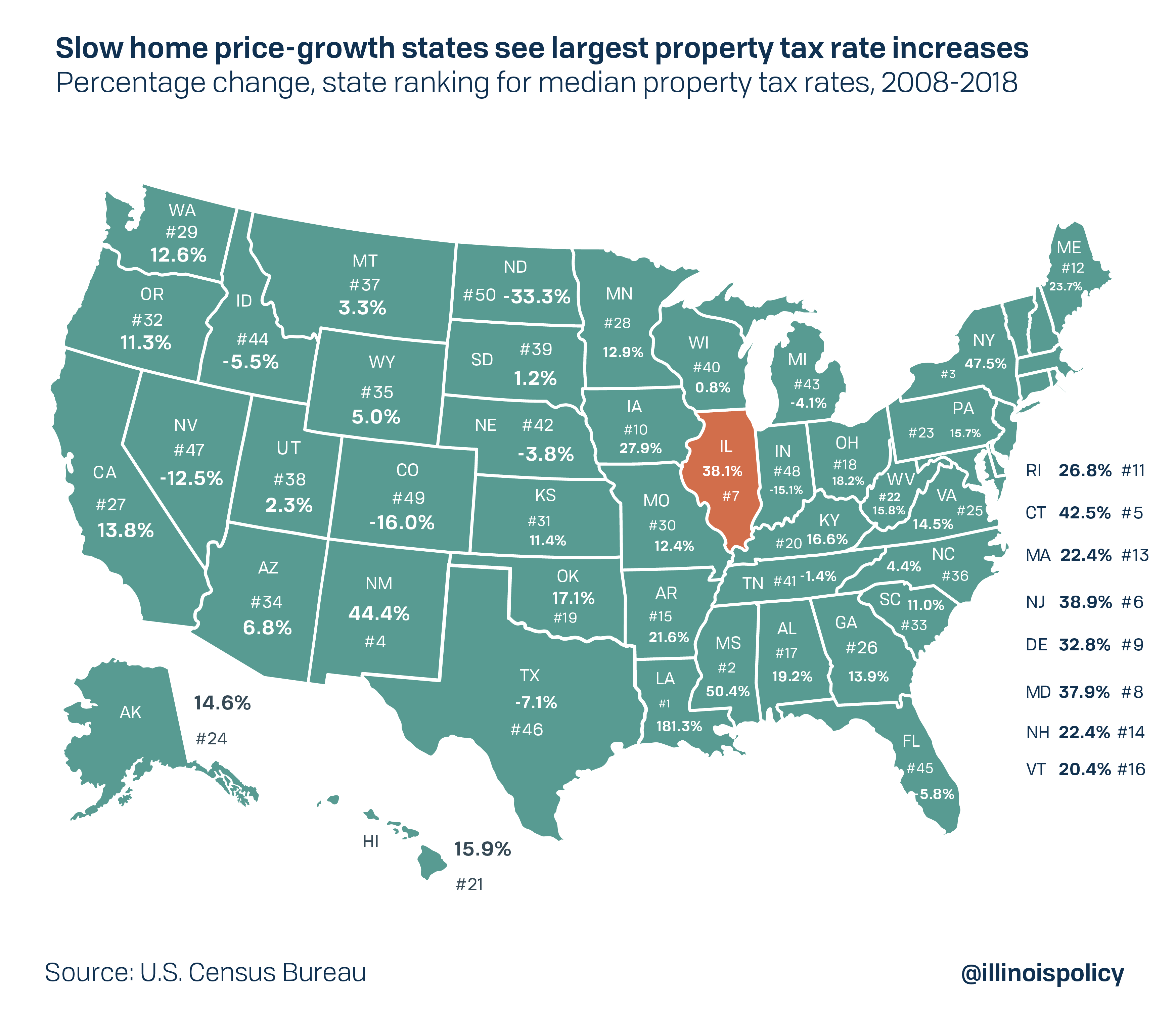

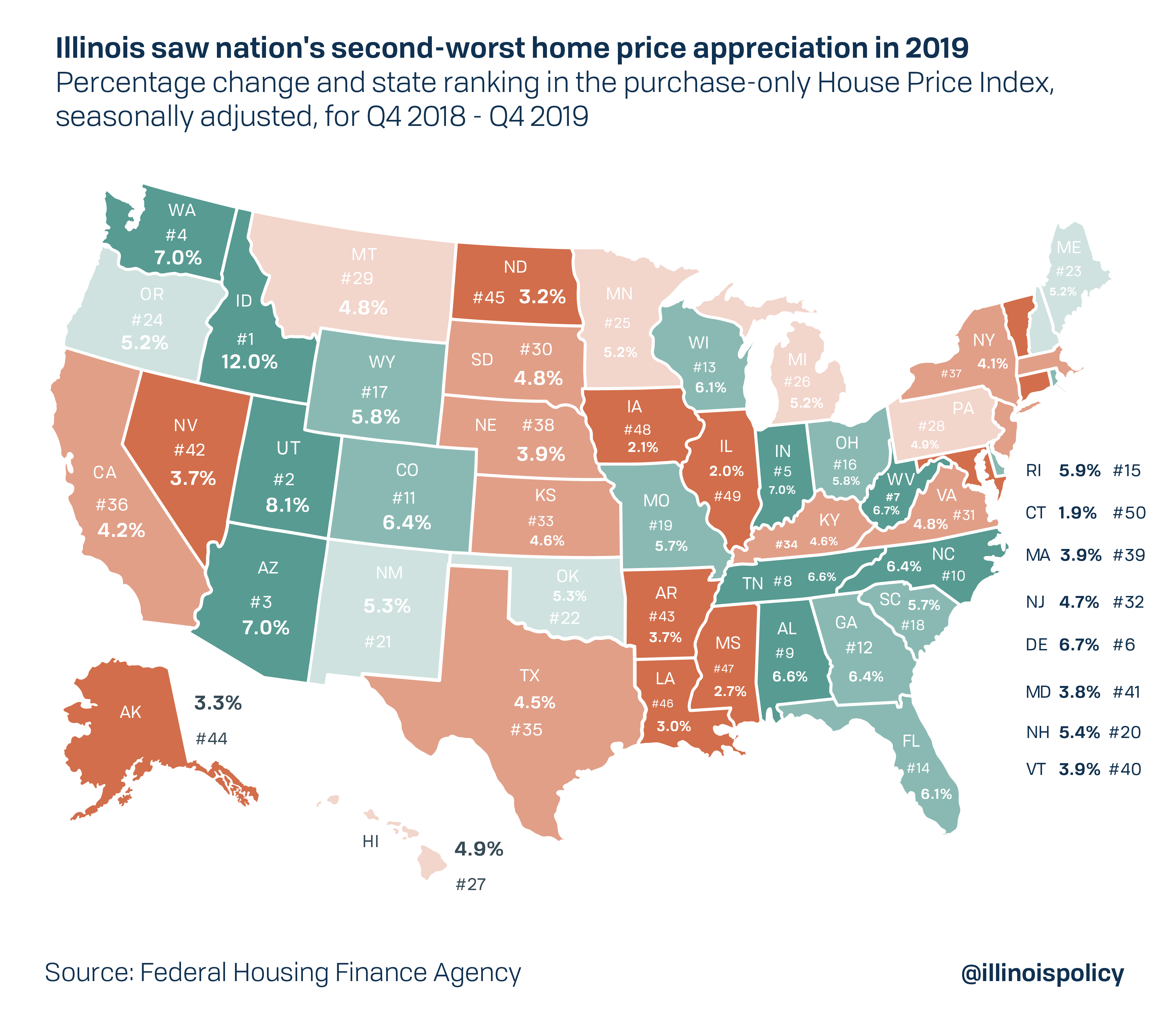

Illinois House Value Growth Nation S 2nd Worst In 2019

Historical Rhode Island Tax Policy Information Ballotpedia

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Illinois House Value Growth Nation S 2nd Worst In 2019

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent