when are property taxes due in will county illinois

① Click on Pay Property Tax. 302 N Chicago Street Joliet IL 60432.

Reboot Illinois Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax County House Prices

Please remember that the figures shown are compiled from data that has been provided to us from various Local Township Assessors.

. Will County Supervisor of AssessmentsProperty Search Portal. Will County Treasurers Office. Box 729 Edwardsville IL 62025.

Will Countys new schedule means half the first property tax bill is due June 3 and the second half is due on Aug. Madison County Administration Building 157 N. Instead of affordable taxation though Will County.

The deadline to pay the Total Amount Due is listed within the Inquiry for each specific year of sold taxes. If you have any questions regarding the accuracy of. Treasurers Office Suite 125 Edwardsville IL 62025.

John Ferak Patch Staff Posted Fri May 22 2020 at 434 pm CT. 3 as the due dates for 2021. In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes.

Welcome to Property Taxes and Fees. Learn About Will County Property Tax Exemptions With DoNotPay. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. ② The next page will be Parcel Number Search. In person from 830 am.

Will County collects on average 205 of a propertys assessed fair market value as property tax. ③ Select State Illinois. The Illinois Department of Revenue does not administer property tax.

IL 50 W Douglas St Suite 1002 Freeport Illinois 61032 815. Will County Clerks Office Attn. Tax amount varies by county.

④ Collector Will County OR Will County Mobile Home. ⑤ Type in your Parcel Number OR Mobile Home Number in the empty box. 2021 PAYABLE 2022 INSTALLMENT DUE DATES FOR PROPERTY TAXES ARE.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Tax Redemption 302 N. ONCE ON THE GOVTECH PAGE PROCEED AS FOLLOWS.

General Information and Resources - Find information. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes. It is managed by the local governments including cities counties and taxing districts.

173 of home value. The Will County Clerk Tax Redemption Department is the only office where you can redeem or pay sold taxes. 1st Installment - Friday July 15th 2022.

Tax Sale Case Numbers. The day before any interest rate change to avoid additional interest charges. It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents.

The County Treasurer promotes an atmosphere of cooperation with all county departments the County Board and private businesses. In most counties property taxes are paid in two installments usually June 1 and September 1. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

You will have the option of paying with an E. The property tax rate in Will County Illinois is 205 costing residents an average of 4921 per year. Will County Clerk Tax Redemption Department.

Even if youve lived in the same area for years you may notice that your rates fluctuate. Tax Sale Information for Property Owners. The state average is lower at 173.

Will County Treasurer Tim Brophy said the board should establish June 3 Aug. Cook County and some other counties use this. Payments must be received in-office by 430 pm.

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. ⑥ Click on Search. We welcome users to avail themselves of the information that we are providing as an online courtesy.

Visit one of the nearly 100 collector banks and credit unions across Madison County. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Property taxesthey can feel like a burden especially in areas with high rates including Will County.

If you are a taxpayer and would like more information or forms please contact your local county officials. Madison County Treasurer PO. County boards may adopt an accelerated billing method by resolution or ordinance.

Will County is growing economically and its residents enjoy a high standard of living with 80 of them owning their own homesBearing this in mind you could expect Will Countys property tax rates to be low and Illinois to be a state with low property tax. Tax Sale Instructions for Tax Buyers.

Cook County First Installment Property Tax Bills Due March 1 2022 Village Of Barrington Hills

How Much Will You Pay For Chicago S New Taxes Chicago Real Estate Chicago Estate Tax

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Illinois Now Has The Second Highest Property Taxes In The Nation Property Tax Real Estate Infographic Real Estate Articles

Property Tax Prorations Case Escrow

States With The Highest And Lowest Property Taxes Property Tax States Tax

Youtube Language Subscrib And View Gk Knowledge Youtube Knowledge

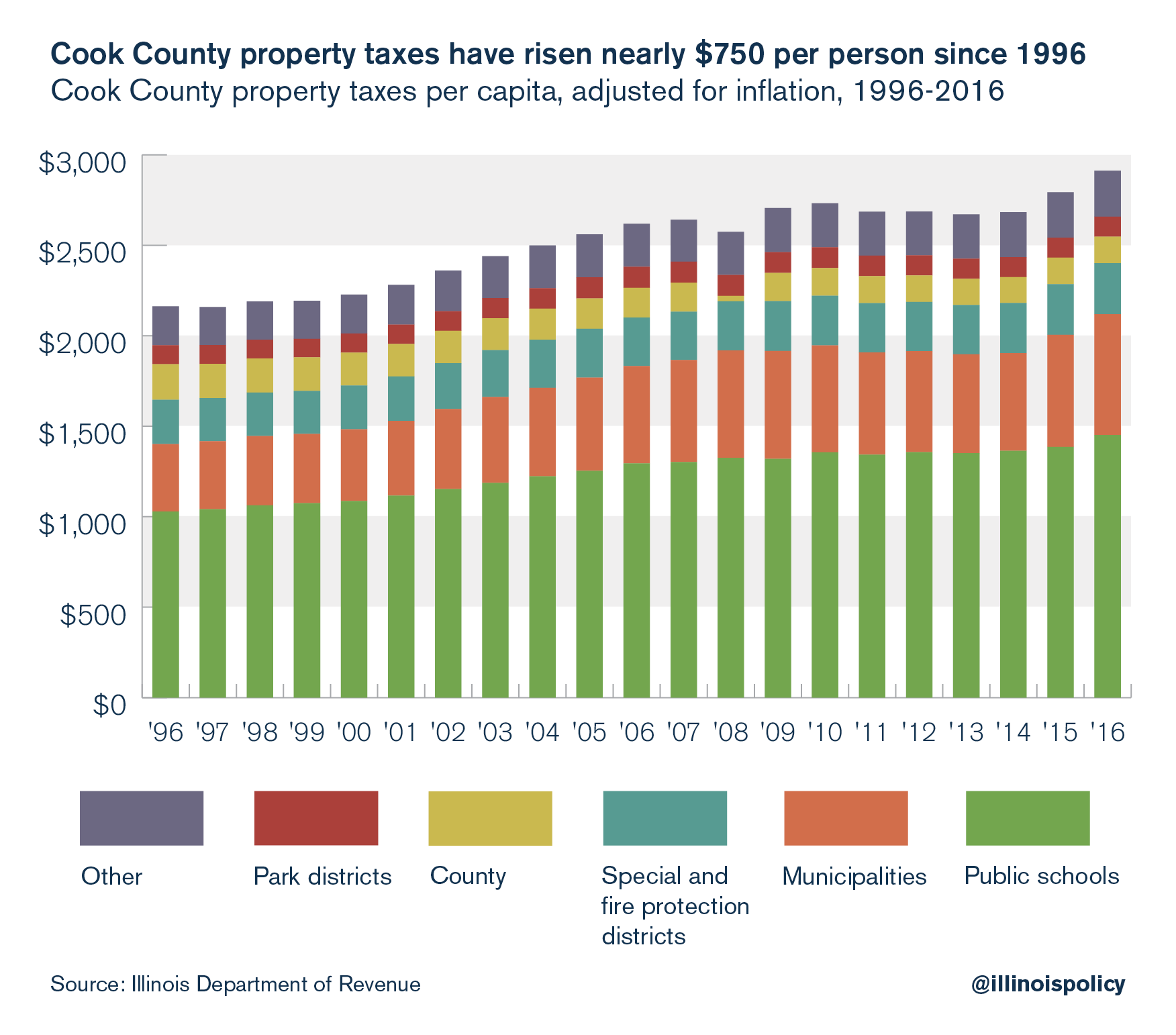

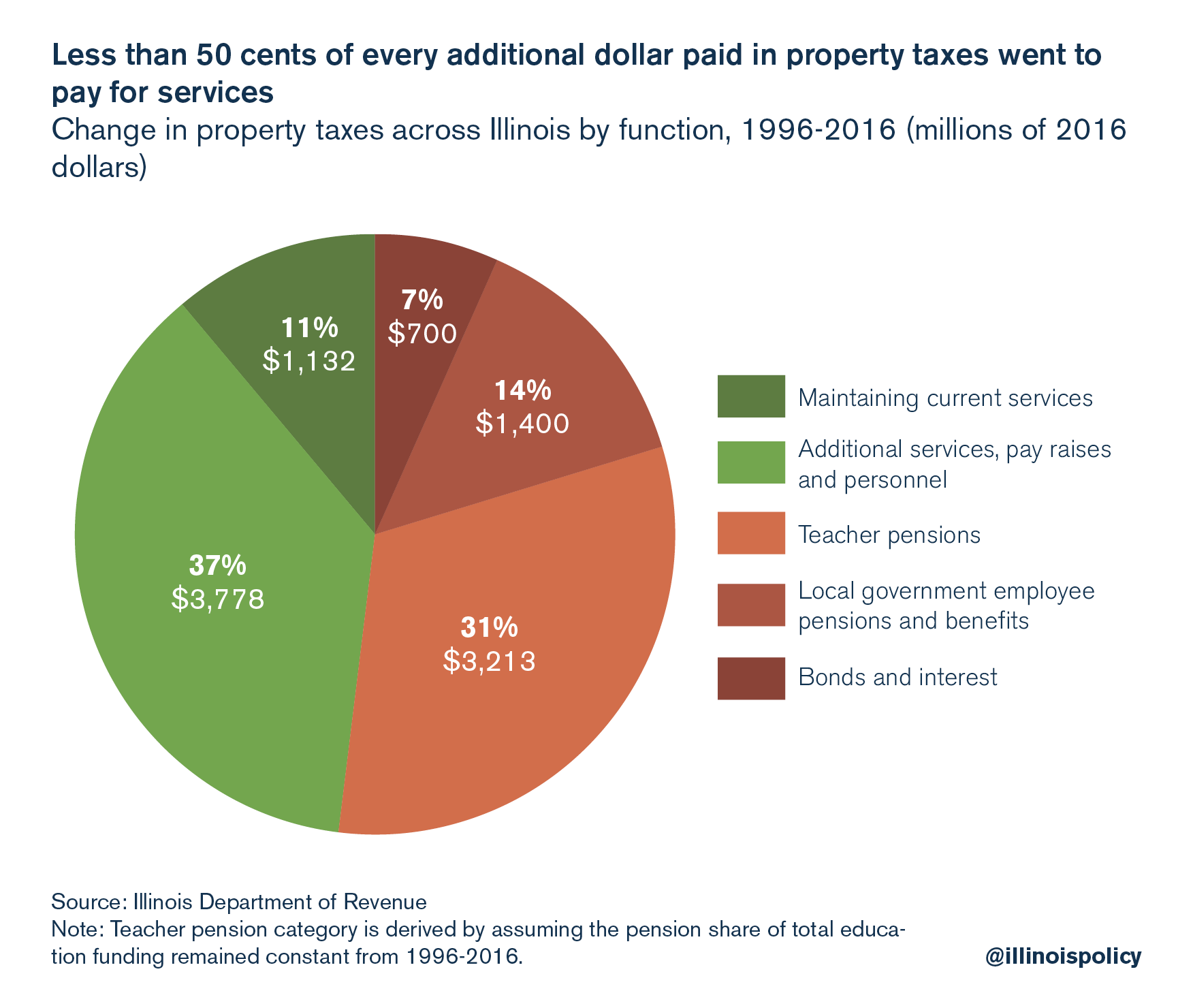

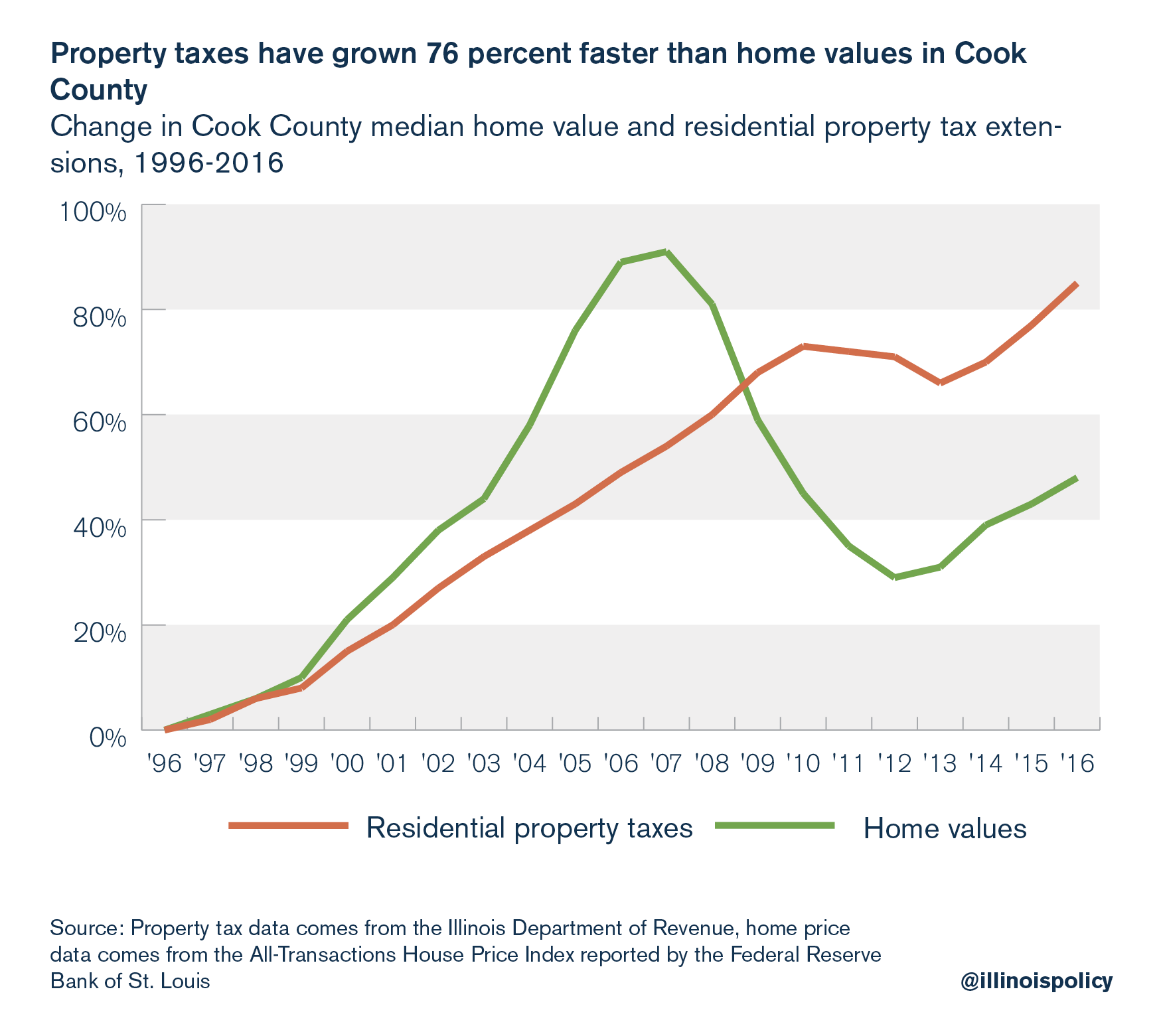

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Property Tax City Of Decatur Il

Pin By Keiram On We Hunt The Flame I Forgive You I Am Awesome I Was Wrong

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Pin By Chris Morgan On Quotes Stephen King Oil Company Medical Billing

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy